“There are no climate leaders…at least not among high-income nations”

With COP 26 starting on 31 October, a plea for nations in positions of influence to use their feet more than their voices has already been demanded by Greta Thunberg, one of the many high-profile voices to issue concern on the lack of climate leaders walking the talk when confronted with the science. Even the Queen has expressed her irritation at those who “talk but don’t do”.

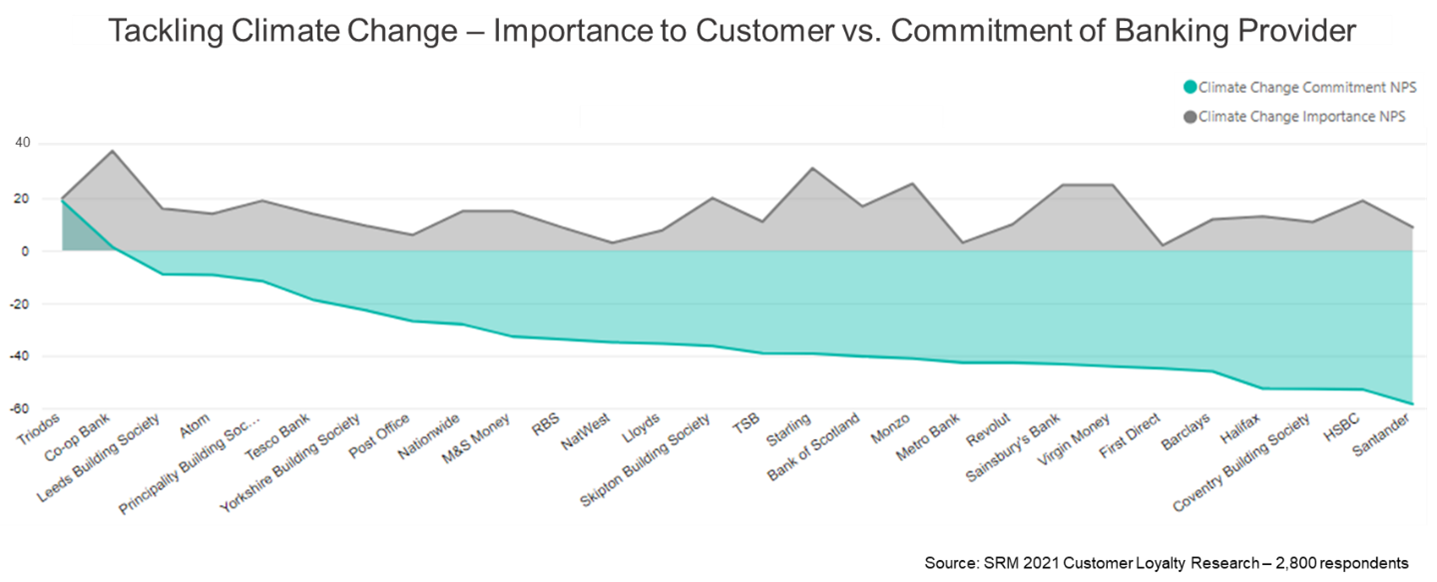

Within the UK Retail Banking sector, research from SRM suggests the silence of leadership is equally deafening. Only two of the 28 brands across Retail Banking and Building Societies generated a net positive score in the eyes of its customers for its commitment to tackling climate change.

This assessment was in stark contrast to the urgency of tackling climate change, which was considered important to varying degrees by their customers and generated a net positive score across the peer group.

So, should the UK Retail Banking sector be doing more? The answer of course is yes. However, at the corporate level talk may well be accompanied by any number of green initiatives, but these are often delivered in parallel with continued financing of carbon generating enterprises, a contradiction banks need to acknowledge.

This paradoxical position is not lost on the end consumer, who deem the efforts of the banking sector well below par – notable exceptions being Triodos Bank and Co-op Bank.

One would presume, then, given their acknowledgement of the urgency in tackling climate change and the lack of appropriate response from their providers, that customers would vote with their feet.

As it stands, this is not the case.

From SRM’s analysis of the factors that influence loyalty, customers give scant consideration to their banking provider’s efforts in tackling climate change. Surprisingly, banks would generate stronger loyalty if they were to do less well on this measure.

Could this be customer scepticism about the seemingly hollow words from their providers, or a desire for banks to focus on service and product value. Or both?

“You must be the change you wish to see in the world” - Mahatma Gandhi

More broadly, SRM found that only 3% of the 2,800 respondents cited Ethicality / Social Purpose as a primary reason for remaining with their provider. As we head into COP 26, customers are expecting banks to do more, but are not yet prepared to hold them to account solely on this measure. So, who will step forward – should banks be leading the way for their customers, rather than wait to be led by them?

Banks must not ignore this aspect of their responsibility and need to continue to adapt their business models, in part funding their actions by redirecting trapped operational costs to help them reduce their supporting role and direct impact on climate change.

So, when Greta says we need climate leaders, the baton is there for the taking for those corporates brave enough to move beyond just owning the narrative – and shaping the path of the journey ahead.

Follow this link to get further insights from SRM’s 2021 Customer Loyalty and Experience research.